As part of the CMU MHCI capstone project over 8 months, team adventurers worked with LH VENTURES to design products for our client’s developing solution, Buying Time, that enables buyers to work closer with the vendors to co-create purchase orders easier and faster. In our MHCI 2017 project, we designed an immersive solution for buyers to easily manage, learn, and plan just inside their assortment. Our solution ties elegantly into our client's platform by using the assets generated in the former as the core of our tool.

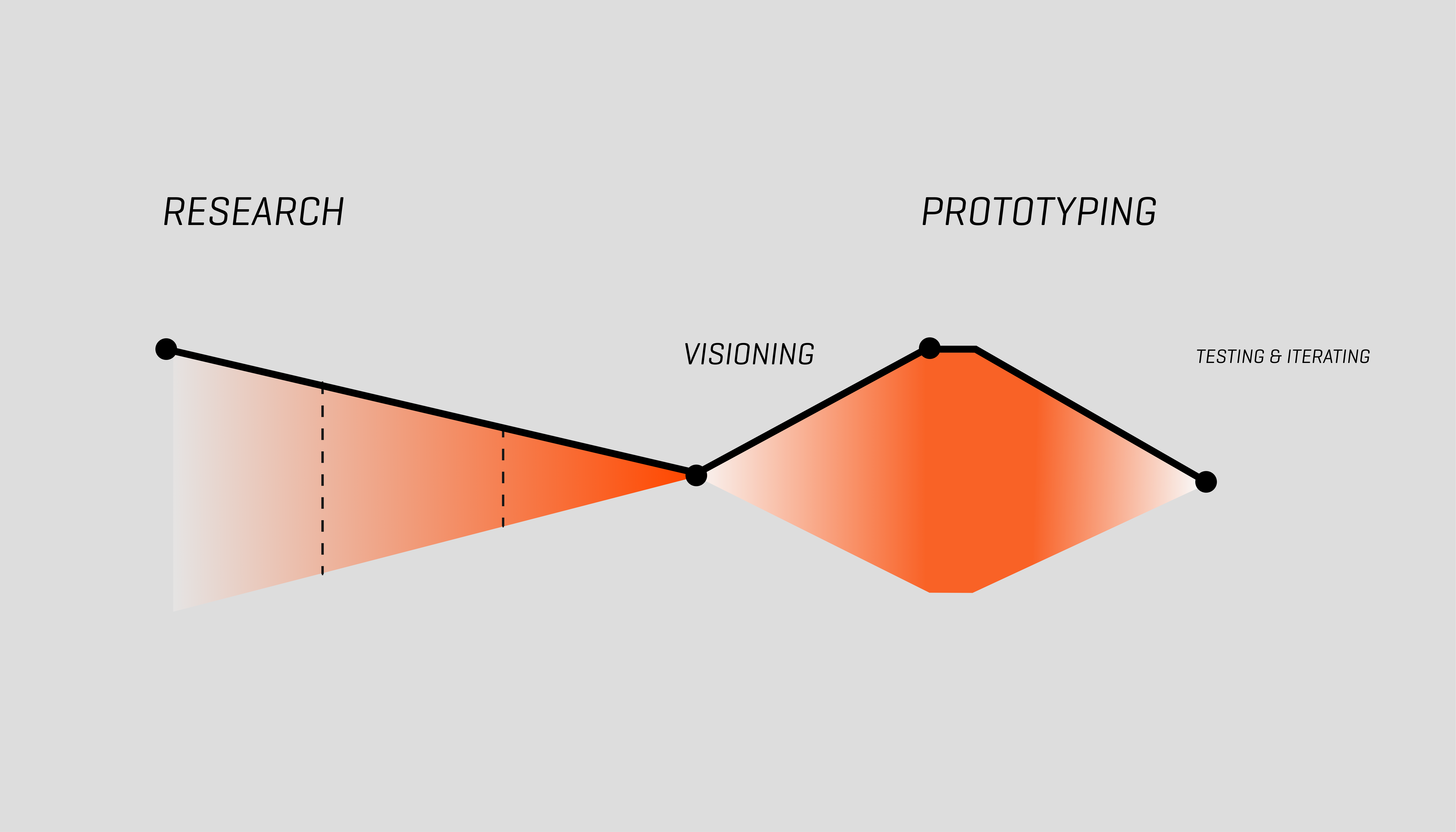

We conducted broad secondary research to familiarize ourselves to what it may feel like and to be like buyers. We reviewed over 40 different academic sources that helped us answer some of the initial questions such as: how is the retail landscape changing and how does the direction it’s heading affect the buying process and how are buyers being trained to learn their tasks.

We interviewed with 42 buyers and started to narrow down on what we started to see in common that contributed the most to their success: the value of vendor relationship, customer knowledge, and agile buying. We asked each buyer what contributes most to her ability to be successful as a buyer. Buyers’ inputs were collected and coded into our card sort analysis.

Over the course of our research, we collected a set of voices we heard from buyers into the affinity wall. After deconstructing our diagram, we were able arrive at our insights that helped us determine areas of opportunities.

Throughout the course of a single buy, buyers engage in up to 40 distinct activities, making critical decisions that affect the success of a product at each point. At any given time, they’re managing several different buys each at a different stage of the process. We grouped these more strategic activities into four opportunities areas where great buyers approach decisions differently than other buyers, and get better results.

How might we help buyers find the compelling stories behind their data so they can be more effective and influencing the strategy?

How might we ensure tools support buyers to be both proactive and reactive depending on the situation?

How might we help buyers see meaningful connections in their data enabling continuous improvement?

We hosted a collaborative a visioning session with our

client generating design ideas to address our insights.

We generated over 25 storyboards, and shared them with users in quick feedback sessions to elicit gut reactions to the ideas and understand how they might fit within a buyer's workflow.

Once we narrowed to a smaller set of ideas, we worked on low and medium fidelity prototypes to build out the complexity of the ideas and tested them with users to narrow to our best idea based on value to buyers, fit within their workflow, and feasibility within our timeframe.

Once narrowed to a single idea, we generated a long list of possible features to include and ranked them based on value to buyers, feasibility, and interconnectedness to other important features and decided on a small set of features to represent our MVP version of the product.

While there are certainly several larger companies and a handful of start-ups designing tools for fashion buyers and other roles in retail, they are still mostly either financial planning tools or visual assortment tools without the ability to ‘slice and dice’ using sales metrics and other attributes. The few examples of competitors that are doing this haven’t been thoroughly tested in the market and it is our suspicion that many corporations are afraid of switching to a new tool because of the costs associated with training employees on the new tool and ensuring compatibility with legacy systems still in use. Our takeaway was that our product can differentiate itself from the competition by more than features alone: the usability and compatibility of our solution will be integral to its successful adoption in the market.