Research

Understanding the Human Factor in Finance

Process Overview

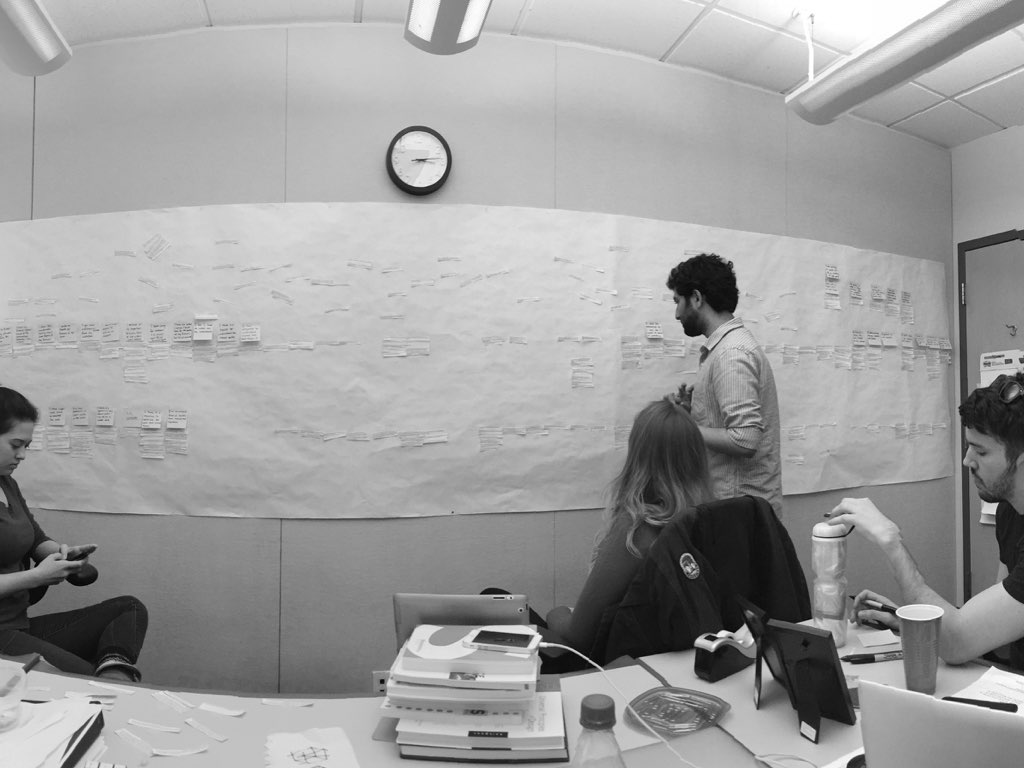

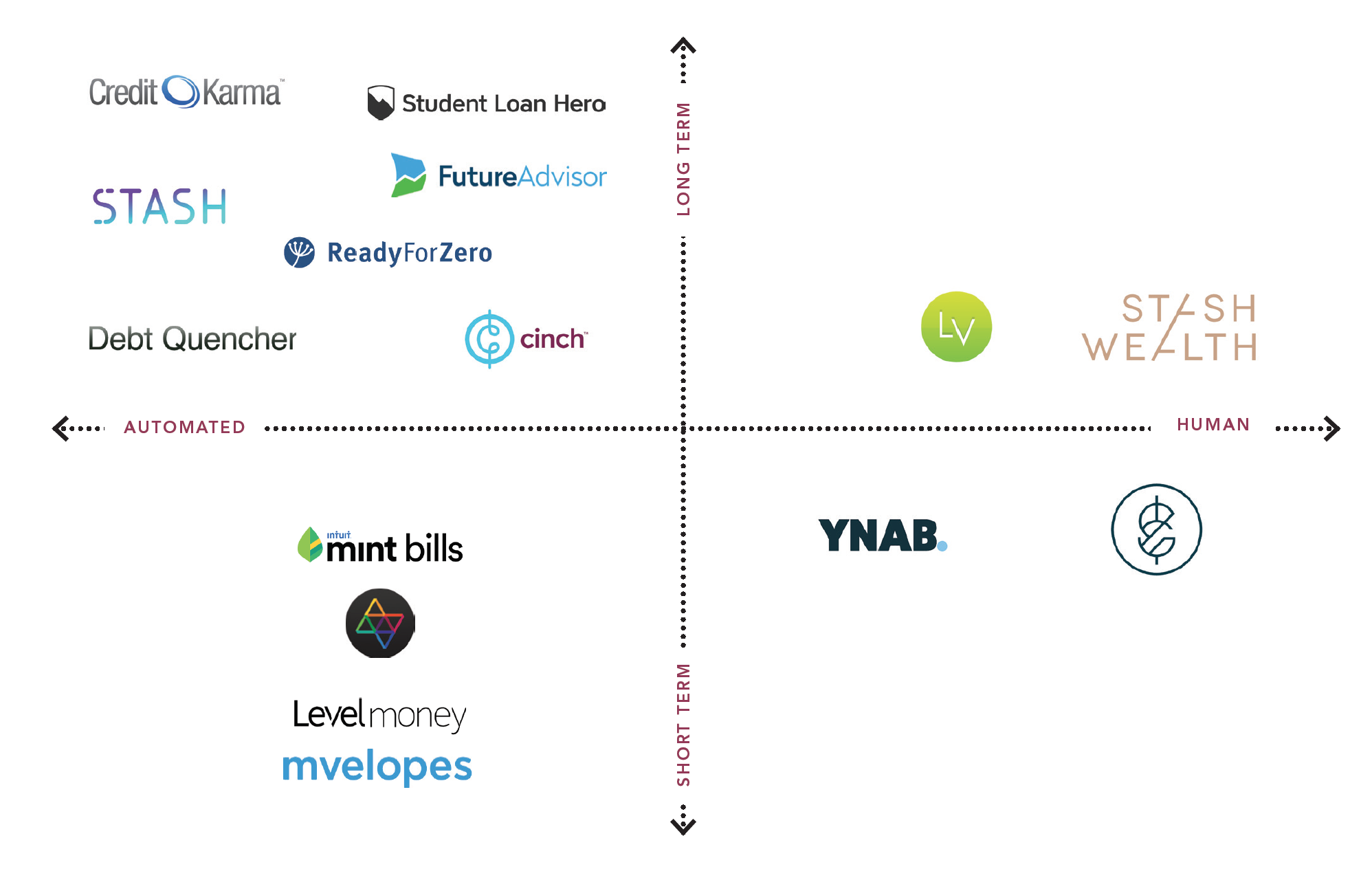

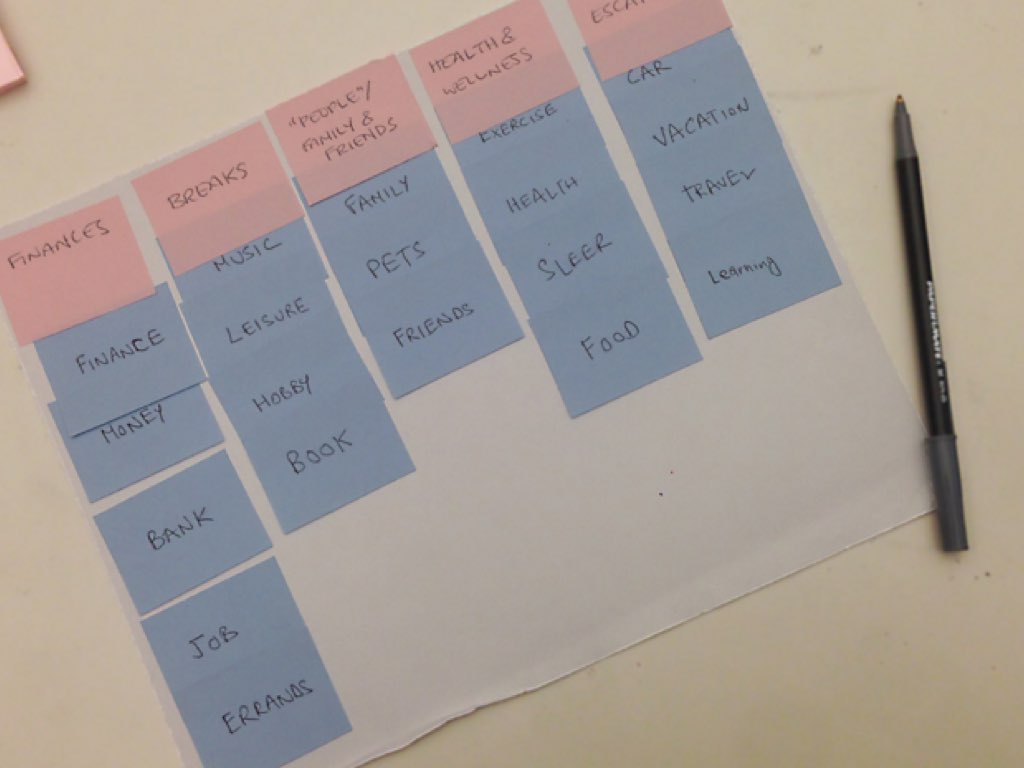

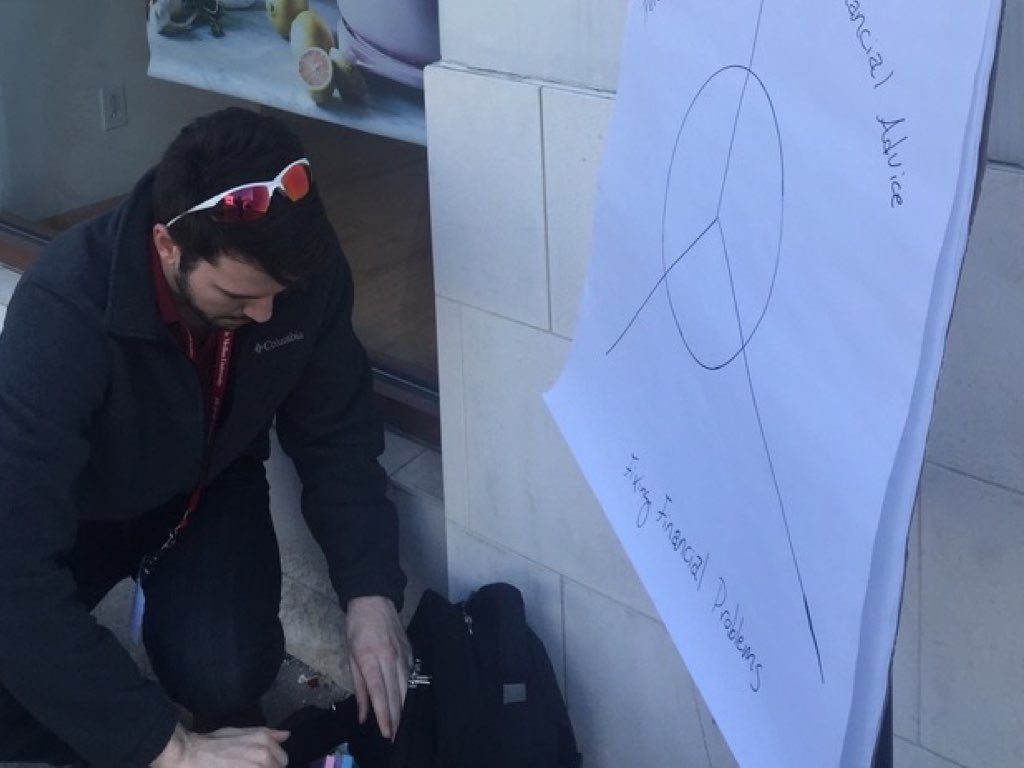

Our research began with a literature review of 24 academic articles and white papers, a competitive analysis of products aimed at helping people manage their finances, and exploration of intervention techniques in four analogous domains. Following our secondary research, we recruited 17 participants and conducted hour long interviews with each. Interviews included open-ended questions, directed storytelling, a card sorting activity, and a radar diagram activity followed by a short survey.