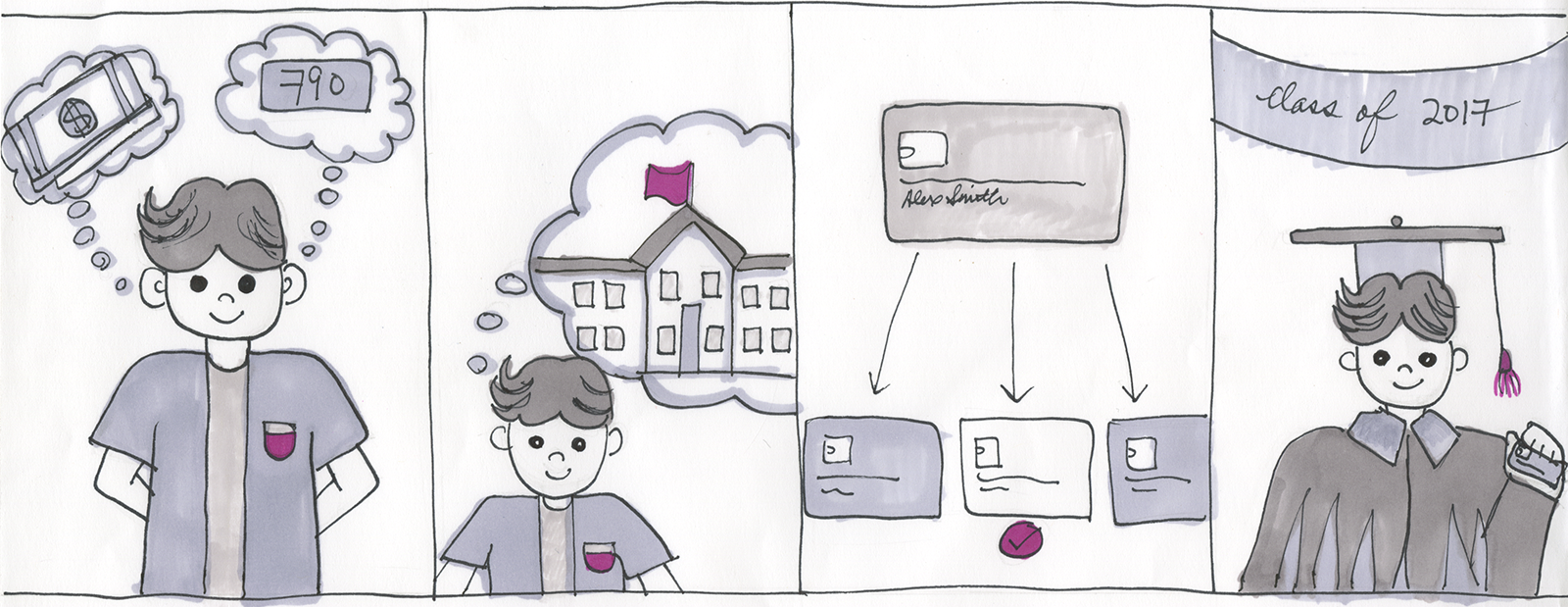

We compared a variety of financial products, explored emerging fintech, investigated Mastercard's B2B2C business model, and mapped users' current credit journey.

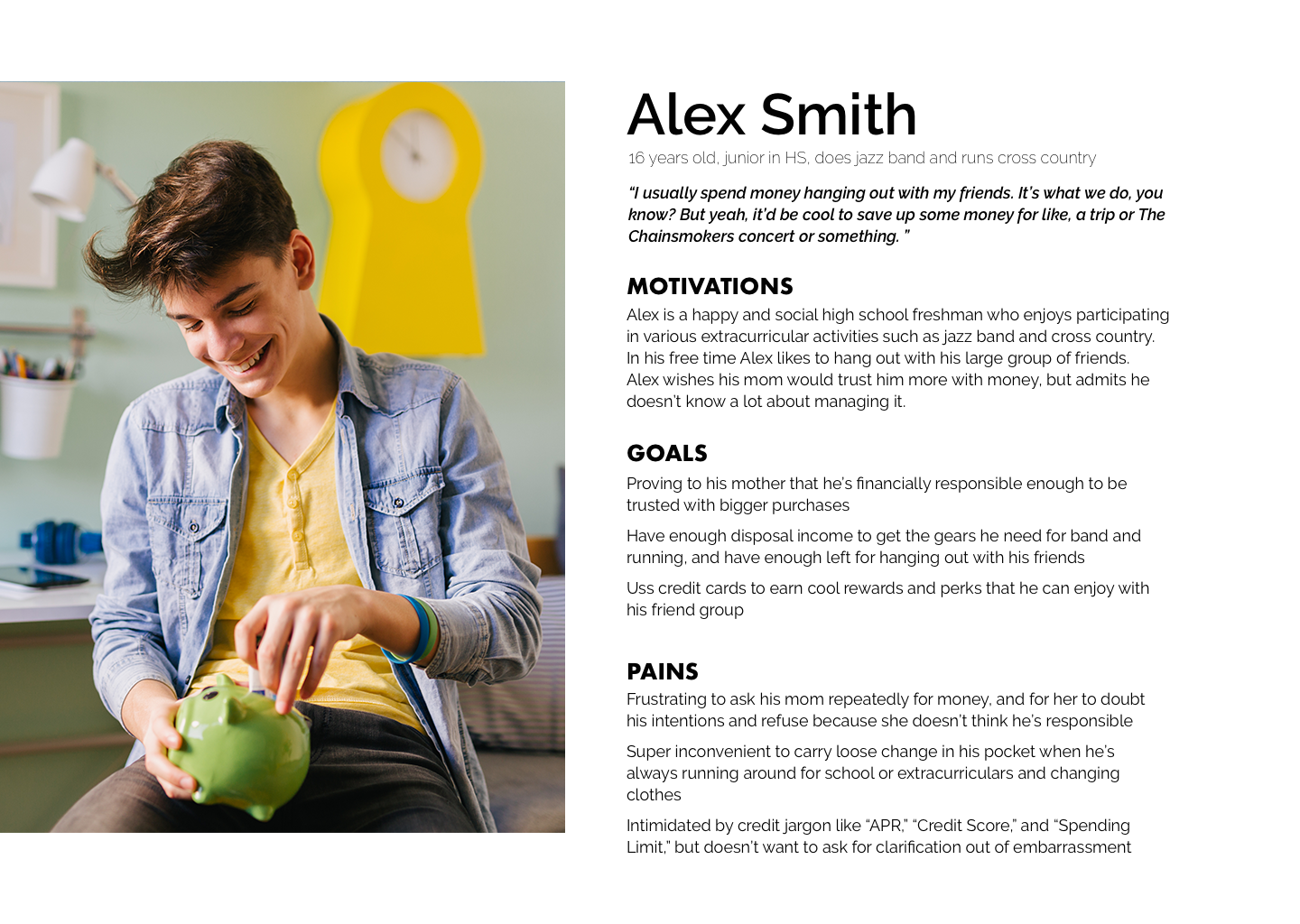

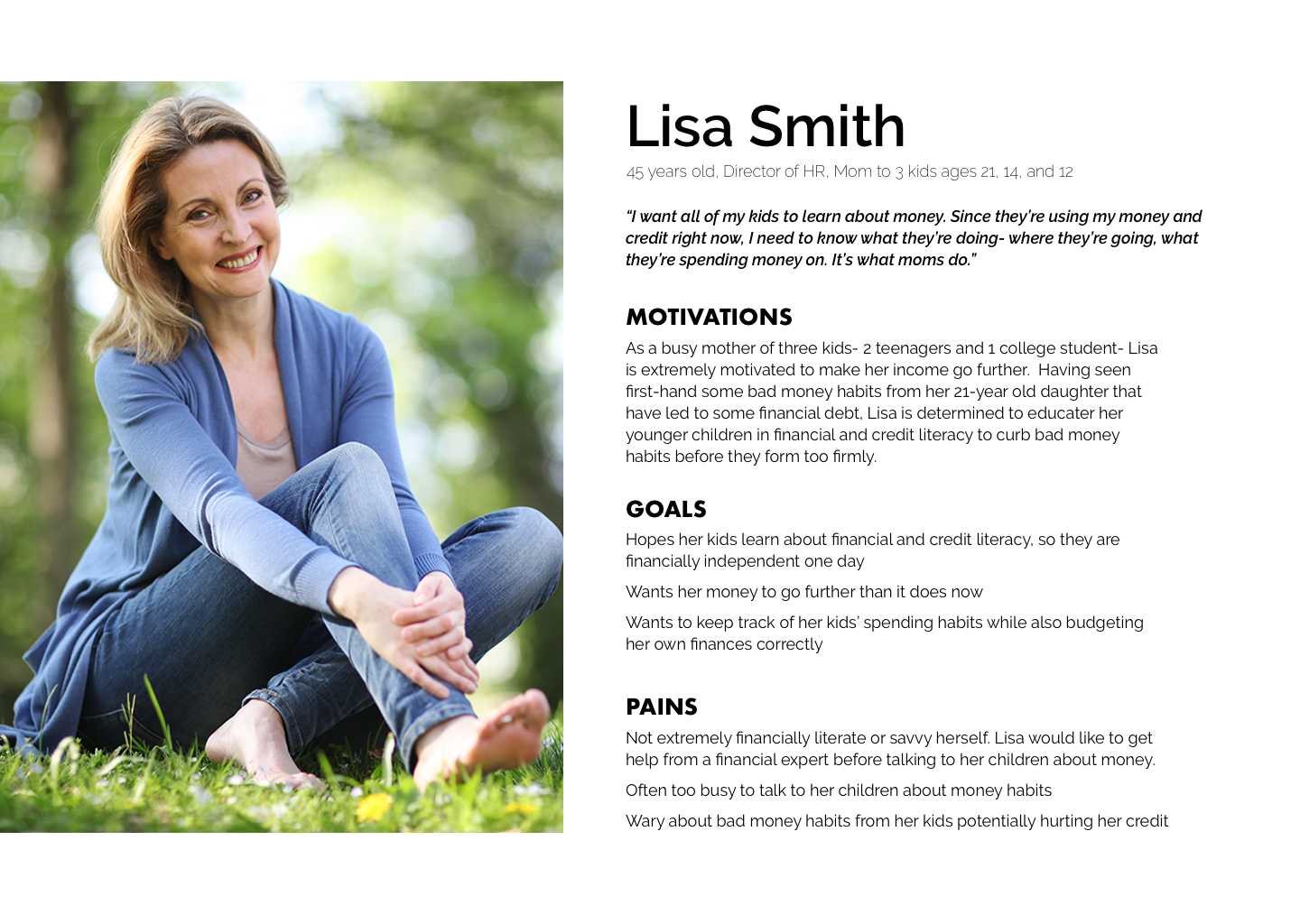

We conducted interviews and generated design ideas through brainstorming and co-design workshops. We validated concepts by testing prototypes with target users.

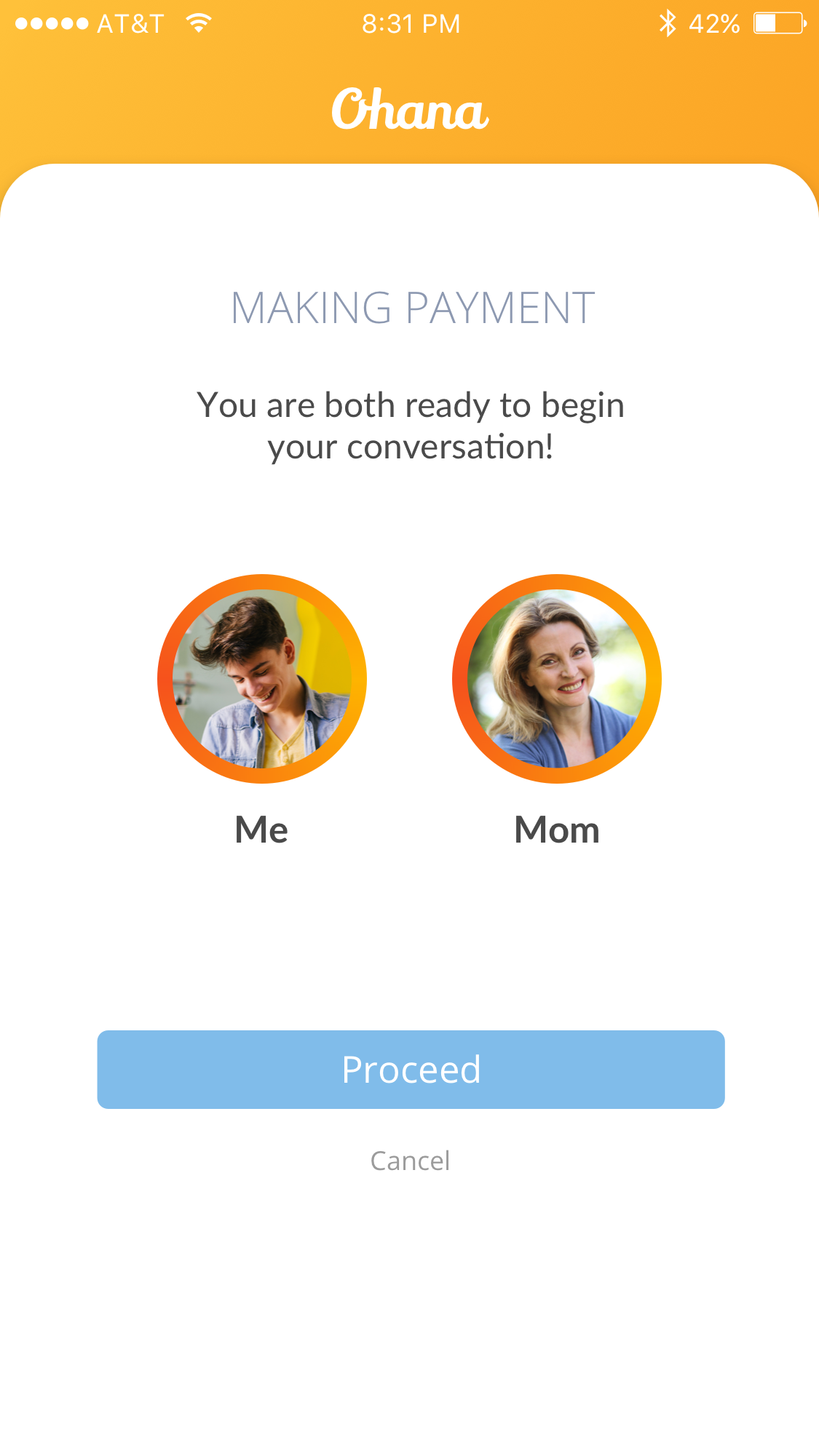

We iterated on our design to build low, medium and high fidelity prototypes. We got feedbacks from multiple Mastercard's internal stakeholders.