PNC Bank offers an extensive range of commercial card solutions sought after by big and small corporate clients for their state-of-the-art technology and attractive benefits. Although these card programs are in high demand, the onboarding process for new clients currently suffers from many problems such as long delays, miscommunications and rework.

Our goal is to pinpoint key issues in the process along with their underlying sources in order to provide actionable insights to the bank. The main findings and opportunity areas uncovered by our research are presented here. By doing so, we seek to help PNC achieve faster revenue generation and a better client experience on one of their most profitable products.

Investigating two main areas: client onboarding and digitization in corporate banking.

Assessing competitors to compile the range of corporate card offerings currently in the market.

Examining the customer experience of analogous onboarding processes in other industries.

The onboarding experience is a vital service differentiator for clients. Banks must demonstrate customer-centric focus to secure a competitive advantage and customer loyalty.

As clients become accustomed to the prevalence of digital platforms in online personal banking, they develop similar expectations of corporate banking.

Legacy banking architectures are expensive, manual, and decentralized; migrating entire processes from these complex systems is time-consuming and costly.

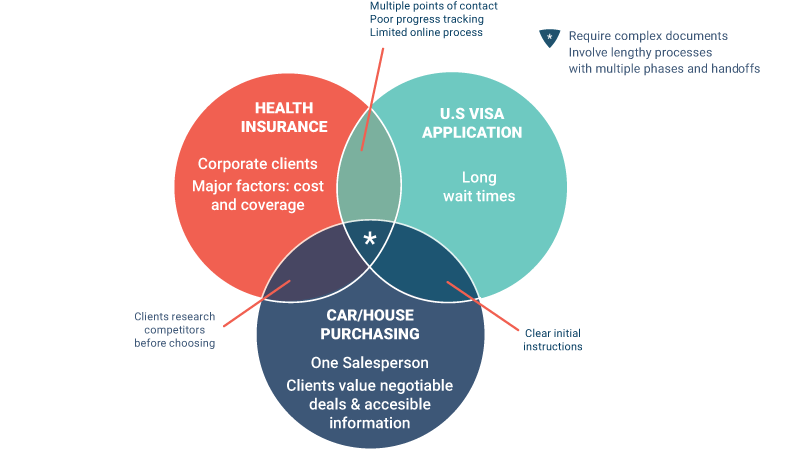

Due to our limited access to PNC Commercial Card clients, it was imperative to examine the customer experience of analogous onboarding processes in other industries. We identified three domains of interest: health insurance, car sales, and visa applications. Interactions in each field involve the transfer of complex information shared with multiple people through various stages over time, a clear parallel to those of card onboarding.

The opportunities to speak with a large number of PNC employees involved with card onboarding became the backbone of our overall view of the roles and perspectives in the process. In order to understand the tools used, we observed the use of multiple internal systems across five roles. We examined employees’ daily tasks, the steps required to complete them, and the many information handoffs. This allowed us to find breakdowns and estimate the complexity of steps.

Ranging from employee training to role hierarchies

Speaking with PNC employees involved with card onboarding

Examining the customer experience of analogous onboarding processes in other industries

Examining daily tasks, the steps required to complete them, and frequency of information handoffs

Evaluating the main onboarding systems against Jakob Nielsen's usability heuristics

Acting the part of a client being sold a commercial card

We synthesized our interviews by modeling the workflow from each interviewee’s point of view while reviewing our notes and audio recordings. After each model was created, we consolidated them into single models that collectively represented the entire process.

A high-level view of how information flows between different roles throughout the process

An inspection of certain workflow sequences (e.g. tasks) in finer detail

A view of organizational and social influences on people and their perspectives

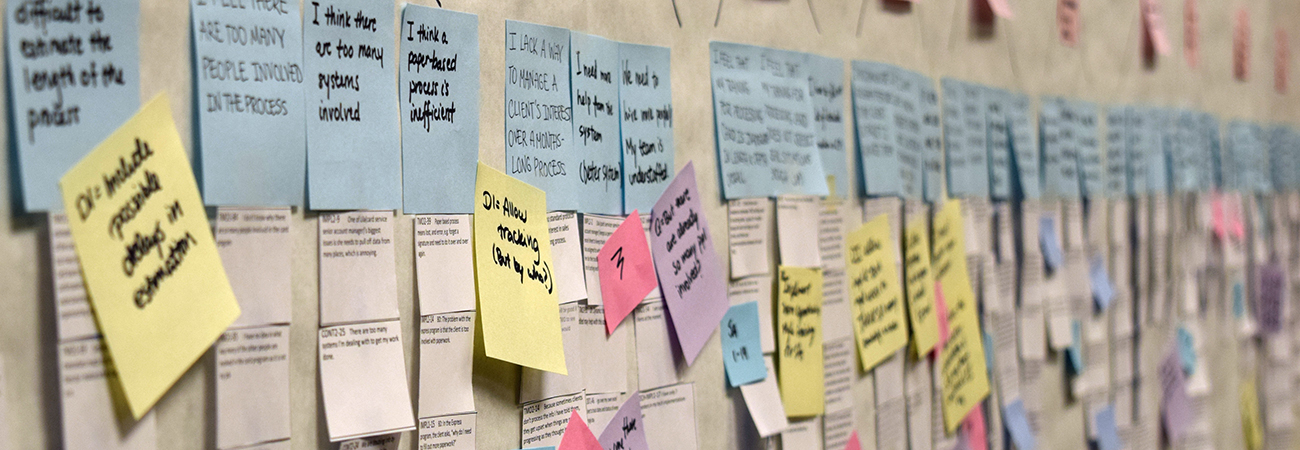

Our interviews collectively resulted in a total of over 1500 short notes. In order to yield valuable insights from this information surplus, we created an affinity diagram: an organization of interview notes in a three-level hierarchy by grouping them under meaningful categories to quickly identify key issues and stimulate future design ideas.

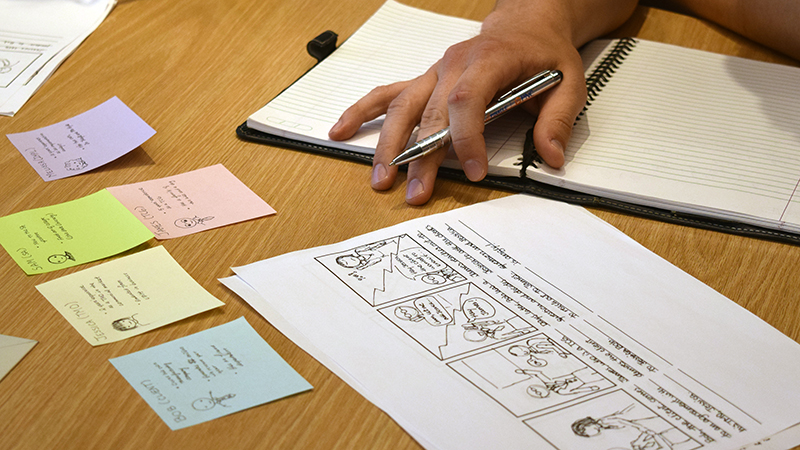

Once we determined what seemed like the most pressing issues, findings validation was the logical next step in our research. We returned to PNC intending to see which problems provoked what types of responses. Each salesperson was presented with a scenario derived from our findings in storyboard form. The results from these sessions informed our choice to feature five major findings from our research.

With the conclusion of our research phase, we moved on to putting our findings to use. We came up with visions for an improved process and evaluated them in terms of organizational alignment and technological feasibility. The most promising of these were turned into low fidelity prototypes. Through testing with PNC employees, we iterated upon the designs until we produced a single high fidelity prototype. Iterative user testing was be conducted up until the final presentation where we demonstrated our solution.